Tranalysis

On the afternoon of May 30, 2024, the Institute of Humanities and Social Sciences of Peking University and the Sanlian Bookstore of Life, Reading and New Knowledge jointly held a reading session entitled "Contributions and Limitations of In-depth Comparative Historical Analysis-" The Path to a Modern Fiscal State "in Conference Room 208 of the Second Hospital of Peking University. The meeting was introduced by Wen Kai, author of the book "The Path to a Modern Fiscal State" and associate professor of the Department of Social Sciences at the Hong Kong University of Science and Technology. Zhang Changdong, professor of the School of Government at Peking University, Tian Geng, associate professor of the Department of Sociology at Peking University, and Du Xuanying, associate professor of the School of History at Renmin University of China, Han Ce, associate professor of the Department of History at Peking University, and Cui Jinzhu, lecturer at the School of History at Capital Normal University, commented. Due to space limitations, the text of this reading meeting is presented in three parts. This article is an introduction made by Professor He Wenkai.

"The Path to a Modern Fiscal State: Britain, Japan and China", by He Wenkai, published by Life, Reading and New Knowledge Sanlian Bookstore in December 2023

The research of this book responds to a number of topics in the social sciences, especially the formation, construction and consolidation of institutions. This is a very important research direction in historical sociology and political economy (including institutionalism). The key issue is that when we conduct research, we cannot use the function of the system to backtrack the process of its creation. Of course, this functionalist approach has been gradually abandoned by the academic community. The emergence and evolution of the system actually involve issues of historical process. If we simplify the historical process, I think it is disrespectful to historical research. However, how to bring the research of history into the research context of social sciences on institutional formation and institutional development as much as possible is actually very difficult. One of the biggest challenges of this kind of research is to satisfy historians and accept it by social scientists.

From the source, my earliest concern was the financial issues of the late Qing Dynasty. When I studied finance in the late Qing Dynasty, I always thought, what was the problem? Many studies on the fiscal system of the Qing Dynasty have a strong post-event perspective, especially looking back from the defeat of the 1894 - 1894, which is actually divorced from the specific historical situation. In fact, many criticisms were untenable in the historical context at that time. If we want to truly understand the operation and characteristics of the fiscal system in the late Qing Dynasty, a comparative perspective will provide some new discoveries.

The earliest batch of theoretical documents would emphasize that Britain has the autonomy tradition of local gentry, and that local governments have the ability to negotiate with the royal government, and gain more autonomy rights through paying taxes, which in turn has the result of strengthening the country's capabilities. This is a more classic explanation in social science. If we look at China's fiscal system from this perspective, there is obviously a problem of over-centralization. It is difficult for local forces or local representative power to enter the operation process of the central finance. Therefore, the operation of the central finance is highly autocratic, which in turn will affect the improvement of national capabilities. As Michael Mann said, the country may seem strong, but in fact its infrastructure power is very weak. I have always understood the Qing Dynasty and its fiscal system within this framework. In addition, comparing the Qing Dynasty with Japan, many existing documents will emphasize the initiative and initiative of the Meiji government in Japan, that is, Japan can forcefully impose very new modernization measures on society and achieve social and economic transformation. In comparison, the Qing Dynasty seemed to lack such capabilities.

However, later, while reading British fiscal history, I read John Brewer's "Pillars of Power", which shocked me very much at that time. Brewer believes that the main body of the British government's fiscal revenue is not controlled by local gentry, nor even from some big financiers and traders. The most important source of fiscal revenue for the British government in the 18th century was the consumption tax collected from ordinary consumers, with a proportion exceeding 40%-50%. The most important one is the beer tax, which accounts for about 20%-30% of the government's annual revenue and has a relatively high proportion. In the entire process of collecting beer taxes, the state relied not on the cooperation of local gentry, but on a highly bureaucratic tax collection agency established by the central government itself. The biggest inspiration from this book is that we may underestimate the role played by British bureaucracy.

"Pillars of Power: War, Money and the Rise of Britain, 1688-1783", by John Brewer, translated by Shan Lingzhi, published by the Commercial Press, April 2024

There are some new inspirations from the above thinking, that is, land tax is not the most important tax category, and the importance of consumption tax or likin is seriously underestimated. Previous research on the fiscal system of the Qing Dynasty, including the financial changes in the late Qing Dynasty and the Republic of China, focused on land taxes. Basically, they used the lack of social penetration of the state power to explain the weakness of the state's capabilities in the late Qing Dynasty. If we change our thinking and focus not on land tax, but on consumption tax, which is more flexible in increasing income, and then look at Likin from a comparative perspective, we will come to an explanation that is different from traditional history. Likin is essentially a consumption tax. The United Kingdom and Japan mainly collect it at alcohol production sites. Although China lacks mass consumer goods of similar production scale, there are many difficult checkpoints and routes during the transportation of bulk goods. The nature of levying a cherkin tax at such major transportation routes is consistent with that of the United Kingdom and Japan.

Even so, understanding the country's capabilities from fiscal revenue alone is not enough to explain the fiscal difficulties of the late Qing Dynasty, because another key issue is how the country uses this fiscal revenue. If fiscal revenue centrally managed by the central government is used as a kind of capital, participates in financial markets, and mobilizes long-term financial resources, it will greatly improve the country's current ability to pay. From this perspective, Japan provides a very good comparative perspective. By issuing long-term public bonds domestically, Japan used tax revenue from the next 20 to 30 years to expand its naval and army armaments before 1894. Moreover, the construction of Japanese railways mainly relies on private bonds and railway bonds issued by the central government. In comparison, China in the late Qing Dynasty lacked this aspect. Whether it was the construction of a new navy or the construction of railways, it still relied on a very limited annual fiscal surplus. This shows the huge gap in national capabilities between Japan and the late Qing Dynasty.

The main question I study in this book is: Why did the modern fiscal state system appear in the UK and Japan but not in China? I did not want to use the word "failure" to describe the fiscal and financial system of the Qing Dynasty, but only said that it did not have the system to build a modern fiscal country. However, many interpretations later interpreted it as "failure", which actually extreme my view. Long-term public debt systems like Britain and Japan relied on indirect taxes to guarantee credit. Is it possible for such systems to appear in the Qing Dynasty? In fact, this issue can be viewed from two levels. The first is at the political system level, that is, will the rulers and officials of the Qing Dynasty accept such a system? The second is whether the development of the commodity economy at that time in the Qing Dynasty could support a country's long-term public debt issued entirely on indirect taxes.

This book draws on many studies of China's social and economic history and finds that the scale of the commodity economy at that time was sufficient to support a system dominated by indirect consumption taxes. Judging from the relationship between the central and local governments, even if the local governments have a lot of hidden illegal income, the amount of tax revenue controlled at the central level is 80 million taels per year. If we only use tariffs and indirect consumption taxes, that is, Lijin, it can still have 3,000 to 40 million taels. If fiscal revenue of this scale was used to mobilize long-term national debt, the entire fiscal operation and national capabilities of the Qing Dynasty, including the modernization of railways and armaments, would change. Therefore, if this system existed, officials in the Qing Dynasty would have welcomed it very much, so why not build such a good system? To answer this question, we cannot rely on our subsequent understanding of the system to push back on the construction of the system, but we must return to the specific historical scene and discuss the direction of the system from the perspective of historical figures.

After conducting an in-depth comparative analysis of the United Kingdom and Japan, I found that in the early and even mid-term stages of this system, almost no one believed that this long-term national debt was feasible. On the contrary, there were many objections, such as Japan's political conservatives hold a very severe criticism of many Westernized fiscal policies. Interestingly, under such circumstances, why are Britain and Japan still working hard in this direction? Only by combining the historical situation at that time and the analysis of specific historical figures can we clarify the mechanisms and driving forces for the formation of a modern fiscal state. This motivation is not something we impose on historical figures from the outside, nor is it provided by making rational assumptions about historical figures afterwards, but the pressure that these historical figures face at all times in specific historical scenarios. I called the financial difficulties and financial pressures faced by these countries at the time a "credit crisis." The "fiscal crisis" mainly refers to the inability of income to make ends meet; in contrast, the "credit crisis" mainly refers to the problem of how a country can maintain its commercial credit after overissuing credit instruments.

From England's perspective, the main problem it faces is the huge short-term debt, which makes it difficult for the country to bear such a burden. There are two directions to solve the problem: one is to convert debt into long-term national bonds with lower interest rates, which will greatly reduce the burden on the country; the other is to let the Bank of England convert these national bonds into capital. Correspondingly, in exchange, the country needs to give the Bank of England a monopoly on issuing bank notes. The situation in Japan is exactly the opposite. During the military operation to overthrow the shogunate, the Meiji government, which lacked both military spending and financial foundation, issued a large number of non-convertible paper notes to cover fiscal expenditures in the first three years of the establishment of the new regime. These non-convertible paper notes were finally imposed on the entire society by the state and turned into paper notes circulating across the country. The convertibility of paper currency is an extremely serious problem. It is not only a question of political credit, but also a question of economic credit. In the process of resolving the credit crisis, both Britain and Japan experienced a process of centralization of fiscal systems.

In this part, I use social science theories to explain the birth of the British consumption tax system and the Japanese fiscal system during the Meiji period with the concepts of tax collection, tax distribution, and bureaucracy in contract theory. I believe that without this pressure, it will be difficult for the system to move in this specific development direction. According to this, it is reasonable that the late Qing Dynasty did not embark on the path of a modern fiscal state. Because before the Sino-Japanese War, the financial operation of the late Qing Dynasty was actually successful, and it solved many problems of internal and external troubles. These successes left the late Qing Dynasty lacking the urgent need to establish a new fiscal and financial system, especially the need to solve problems by issuing long-term bonds. Therefore, the explanatory framework of this book points out that it is the lack of a "credit crisis" that institutional construction loses the motivation to continue to develop in a specific direction. However, we should not simply regard this inertia as a failure of the Qing Dynasty.

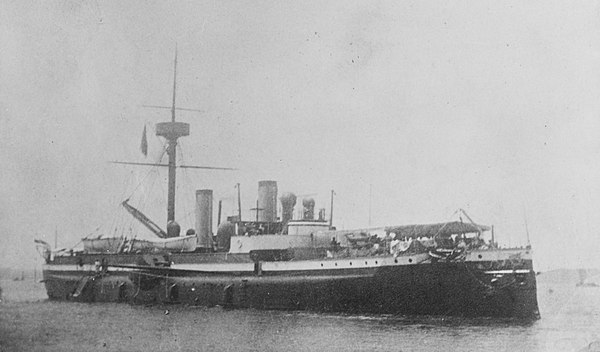

Come to the distant ship

To study the financial system of the Qing Dynasty, we should especially talk about the relationship between the local governments (governors) and the central government, such as how much income was concealed by the governors. Looking back at the archives, you will find that the political authority of the central government is actually quite strong. Previous research by Professor Liu Guangjing and Professor He Hanwei also pointed out that the central government has very strong political and financial control capabilities. Looking at the financial operation of the late Qing Dynasty through historical archives, I found an interesting point that under the decentralized financial system, the governor's financial operation mainly relied on the instructions of the Ministry of Revenue. However, the instructions of the Ministry of Revenue itself lacked clear numerical support. In this case, the governor largely used the transfer of various funds to handle urgent tasks assigned by the central government, such as repayment of foreign debt, military expenditures, and purchase of warships. These are emergency payments and must be completed no matter what. For many major livelihood projects, such as the maintenance funds after the Yellow River burst, the governor also tried his best to meet the needs assigned by the Ministry of Revenue in the same way. However, in terms of the allocation of non-emergency funds, local governments can delay as much as possible, either symbolically allocate part of the funds, or simply regard it as a document. For example, this is the case with the governor's payment of daily expenses allocated to the Beiyang Navy by the Ministry of Revenue and the Navy Yamen.

It can be seen that this fiscal system does have considerable inertia. On the one hand, it can deal with many urgent problems it faces. On the other hand, on non-urgent issues, fiscal arrears do not cause serious political consequences. Therefore, we need to talk about the inertia of the fiscal system in the Qing Dynasty from this perspective. The last question is whether the scale of financial system development in the Qing Dynasty could support the construction of a modern fiscal state system. I used the compensation method of the Sino-Japanese Compensation to infer this counterfactual hypothesis. The Qing Dynasty borrowed money from banks in Britain, Russia, Germany and France to repay the compensation demanded by Japan. It needed to send the annual interest on the debt to Jianghaiguan at a certain time. If the Qing government lacked strong administrative capabilities at that time and ordered the governor to send this money to Jianghaiguan on time, it would not be able to bear the interest on the debt. But what I saw in the archives was that nearly 95% of the annual fees were paid on time. This shows that the Qing government actually had the ability to issue long-term bonds, but did not do so because there was no emergency forcing it to go the path of long-term bonds.

Finally, there is another question: did Chinese private investors and businessmen at that time have the desire and ability to purchase national debt? Or do they have a sense of trust in national debt? My treatment of this issue in the book is a little more extensive. If only from a hypothetical perspective, if the Qing government pays interest on time every year, people who invest in national bonds will benefit, and the Qing government itself will also benefit from the income of national bonds. A lot of benefits will be gained. From this perspective, the Qing government had no motivation to violate credit relations. Similarly, if you look at the UK and Japan, credit was unstable in the early stages of government bond issuance until they were able to support growing national debt with stable tax revenue. Therefore, in my opinion, the trust of private businessmen in the Qing government is not a fundamental issue.

Generally speaking, this comparative research framework involves many issues of national history. I personally have tried my best to collect and use many first-hand archival materials, especially in the Japanese history and Chinese history sections. The British section mainly draws on the research results of British historians. Looking back now, the British part can be done more carefully. At that time, I should have spent half a year in the UK to do some archival research. In this way, the arguments of this book might be more rigorous. Today, there are three experts in national history here, and I very much hope to hear from their perspective the explanatory framework of this historical case analysis, the shortcomings of this research and the areas where we can continue to improve.